In terms of modern commerce, the Direct to Consumer (DTC) trend is still relatively new. Generally speaking, it began to get serious traction around 2010 when barriers to entry were low and investment dollars focused on headline growth, rather than profitability. Most early DTC brands targeted Gen Z and millennial consumers who were looking to try new brands with a bigger purpose – something they could relate to on a personal level.

While apparel, fashion, food and home were strong categories early on, ultimately direct-to-consumer quickly covered all major parts of the market.

Markedly ranging from socially conscious jewelry brands like Alex and Ani, to Casper the mattress company that’s now diversifying into different products and becoming a “sleep company”, to big ticket items like Tesla. With less reliance on third parties, limited/zero contracts and minimal fulfillment needs numerous brands struck up valuable direct relationships with their end consumers.

Some direct to consumer brands have matured after having made the initial foray into the mainstream. Having gained traction, they have now started to encounter some challenges. Notably including the need to be profitable, scaling and attracting new audiences – all while retaining existing ones in a cost effective way.

As core direct to consumer buyers now transition to a mindset impacted by the pandemic into a more frugal buying mindset, additional challenges are arising.

This episode of our “Marketing During COVID-19” series examines some of the technologies, processes and marketing channels that DTC brands need to embrace in order to prosper:

Leading with a Purpose

Most direct to consumer brands have a very strong “brand purpose”, a story and goal that helps them connect and gain traction with their intended audience. With this in mind, many brands looked towards new and trending platforms as a way get their brand’s message and purpose out to consumers.

In fact, due to their visual nature and real-time targeting features, Instagram and Snapchat were the birthplace of many niche direct to consumer brands.

Targeting audiences with purpose filled messaging, across specific digital engagement channels helps many businesses in the early states of brand incubation. In addition, utilizing social platforms created a lower barrier to entry for a diverse number of brands. Brand mission and purpose messages help to build the top of the funnel, resulting in relatability of the brand between early adapters and customers.

Focus on Customer Rentention

While brand purpose may capture the attention of consumers, it certainly is not enough to retain them. In order to create successful subscription models, loyalty programs, repeat customers and ongoing lead nurturing you must look to the bottom of the funnel.

Ensuring longer term health of a direct to consumer brand or business means putting a heavy focus on your higher scoring, more nurtured leads. More specifically, utilizing customer data and combining branding and performance in campaigns to optimize retention.

Adapting for Growth

The ability to transition from pure branding to initial product launch, through building in-house teams to nurture the funnel and progress business growth was a challenge for many brands before the pandemic. Now there is an additional level of difficulty when determining how and where to expand. Standard methods of adapting for growth are changing.

In other words, the way direct to consumer brands must incorporate programmatic, enabling marketing automation, utilize data, develop creative and invest in paid social and search promotions are rapidly evolving.

Developing a marketing mix that offers an optimal cost effective ROI will be experimental in this new post COVID landscape. Brands will need to balance tried versus new, to create a marketing plan that enables sustainability.

The top 3 business KPIs for direct brands are profitability, consumer satisfaction, and new customers.

Trying the “new” will need to be in small iterative steps, with learnings that need to be incorporated into future planning. Certainly in the new COVID-19 impacted economy, where media buying, cost of media and the places where eyeballs congregate rapidly changes and evolves. It is important to note that this is specifically impacted by geographies. Different lockdown procedures in various locations greatly impact how and where people are shopping online. For instance eCommerce buying maybe online, but fulfillment and returns are still in the physical world.

Diversifying Engagement Channels

As the cost per acquisition for direct to consumer brands becomes important, erratic, and fluid in this new frugal economy, it becomes critical to focus on channel diversity and mix. Diversifying channels gives DTC brands a greater audience mix and reach.

While the most popular channels, Facebook and Google, offer scale they are not necessarily the most cost effective channels. It is becoming more and more imperative for direct to consumer brands to craft and build disparate digital advertising and customer communication. Explicitly focusing reach across a greater cross section of digital channels rather than focusing efforts on one solitary channel.

With this in mind, it is important that direct to consumer bands utilize channels that they can manage and control. Most importantly when it comes to buying behavior and customer data. The more data they have on customers and buying behaviors the lower the ongoing cost of customer acquisition and retention.

Shifting to Marketing Cloud Platforms

At Theorem, we support all major marketing cloud and programmatic platforms. We have been supporting a myriad of brands both direct to consumer and traditional through our Business Continuity Planning for COVID-19. Because of these relationships, there are some trends that we are already seeing take shape.

Among or customers, we have seen an increase in marketing cloud related projects while programmatic buying tasks have shrunk.

In particular, we are seeing marketing cloud design, architecture and managed services holding steady. Some in certain platforms are steadily increasing.

It’s no coincidence that marketing cloud platforms provide the most comprehensive way for brands to create and implement effective marketing. Enabling one to one personalized communications with their end customers and optimizing the cost per acquisition. As direct to consumer brands mature, they become much more conscious of margin, just like the traditional retailers have been for years.

Incorporating email, the most preferred direct communication channel between brands and consumers is just one appealing attribute. In addition, marketing cloud platforms have hooks into DMP’s and make site enabled user journeys trackable and insightful. Some even integrate effectively with site analytic tools like Google Analytics.

Providing direct to consumer brands with the most cost effective way to retain and attract new audiences across various channels, while retaining technology control in house.

Exploring New Mediums

The number of channels available to DTC brands continues to evolve. As quarantine takes hold in households around the globe, video and audio streaming are skyrocketing. Ad supported OTT and radio streaming models are offering new engagement channels.

Certain behaviors in some households may even persist post pandemic. In-housing of agency like skills allows direct to consumer brands, and even traditional brands, to experiment, execute and evolve within these new channels. Having the ability to trial and pivot as new channels emerge will lay the groundwork for future marketing trends. Making some channels part of the brands ongoing mix, in a cost effective and efficient way.

Take Quibi, for example. Right out the gate, Quibi launched with an ad-supported model and a paid-for-ad-free model. While more traditional streaming services tended to opt for one or the other.

Audiences who embrace and interact with direct to consumer brands are born “cordless”. They predate cord cutters. Thus, understanding which and what channel format works for the brand and has the widest reach to those audiences will be critical as OTT and connected TV takes hold in mainstream.

Leveraging the Bigger Players

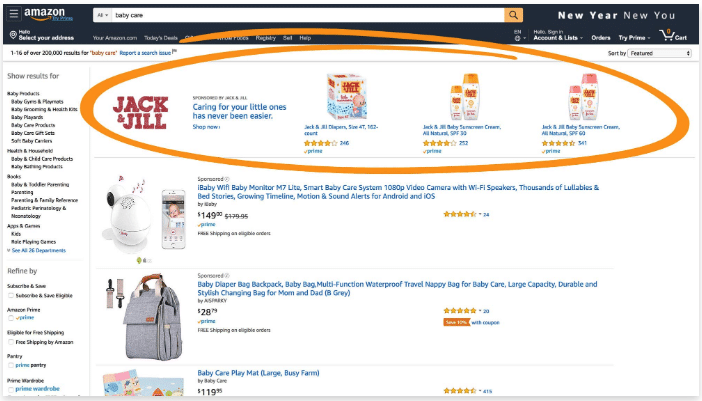

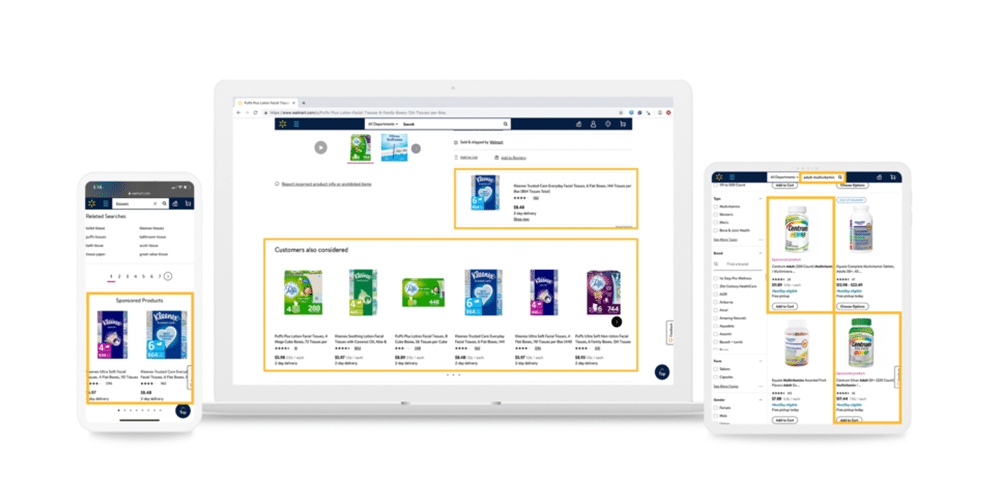

As well as bringing customers to channels they control, director to consumer brands need to consider leveraging some of the bigger players in order to scale. Specifically those in retail can look to large platforms like Amazon and Walmart, as a marketplace for sponsored product placements and brand exposure.

As well as brining customers to channels they control, director to consumer brands need to consider leveraging some of the bigger players in order to scale. Specifically those in retail can look to large platforms like Amazon and Walmart, as a marketplace for sponsored product placements and brand exposure.

When tied to marketplace, it offers another channel at scale. Not to mention its ability to further drive down the cost of acquisition and retention. Skills and technologies needed to make a presence – user experience, SEM, SEO, data, programmatic, retargeting, etc. – can be ported over to Amazon, Walmart or other host.

It is important to note that partnerships are a trade-off. As with all retail distribution partners, direct to consumer brands will inevitably lose some control over pricing and promotion, as they look to scale-up.

Optimizing Profitability

As some of the digitally native brands have gone public, the direct to consumer movement has come of age. Direct to consumer brands now face additional pressure to either shrink their losses or turn profitable. For private digitally native brands, it’s imperative to become profitable. As additional funding becomes more expensive or outrightly difficulty in light of COVID19.

Meaning digitally native DTC brands will need to explore their options when it comes to optimizing profitability. Among the best ways to do that is increasing their direct to consumer strategies across their most effective channels while experimenting with new channels and mediums to increase ROI and ensure sustainability.

Ironically the financial discipline being imposed on digitally native DTC brands will seem almost a no brainer for traditional brands to adopt. The generation living through the pandemic will accelerate that shift as they become more frugal and guarded in their spends.

Shifting to a New Normal

There is no doubt that the world will be different after this pandemic. Many of our traditional ways of life will never go back to the way they were a few months ago. Physical shopping will change in profound ways that will continue long after the vaccine for COVID-19 comes along.

DTC brands were always digital native first. It will be interesting to see how physical brands will transition to the digital world. While direct to consumer brands don’t have the cost structure of physical brands, the ongoing cost of acquiring and retaining eyeballs in the digital world will not be trivial.

All in all, costs of continuing to test new channels and marketing mix models, with rather sophisticated platforms, will rival any fixed physical costs. Brands of all shapes and sizes will need to adjust and adapt to these changes as they evolve in order to survive.

In Short

The examination of how direct to consumer brands and traditional brands will need to evolve their businesses to get through the pandemic, and thrive long after, will need closer study.

Digital marketing skills, expertise in fast evolving technologies and associating with partners who can help with ongoing design, architecture, implementation and ongoing manages services has become all the more critical for survival and scale in the post pandemic economy.